Total Loss Appraisal Insurance Claim Disputes

Definition:

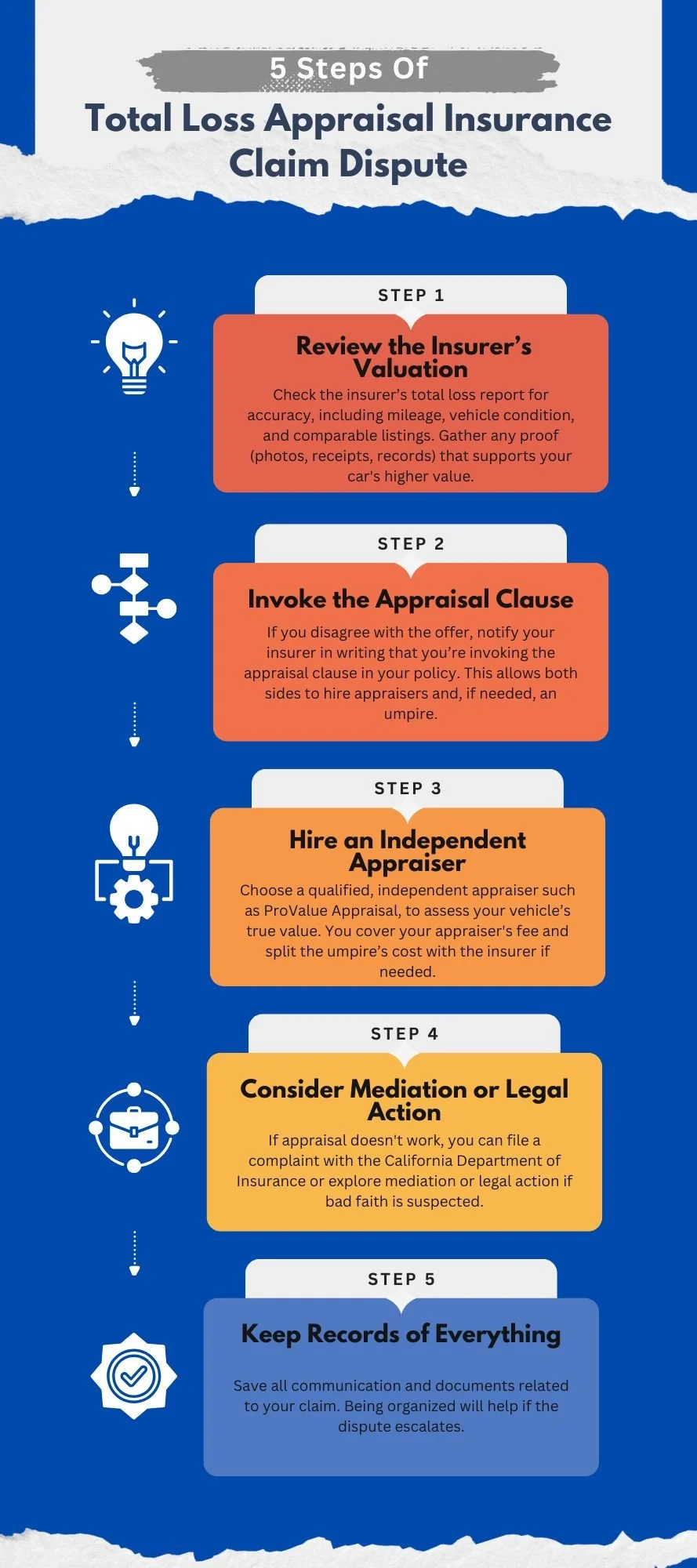

Total Loss Appraisal Insurance Claim Disputes happen when a car owner and an insurance company disagree on how much a totaled car is worth after an accident. If they can’t agree on the payout, both sides can hire their own appraisers to figure out the value. If those appraisers still don’t agree, a third person called an umpire helps make the final decision.

Free Review of Your Total Loss Claim!

When and why does a claim dispute happen?

1. Low Valuation Dispute

The insurance company declares your car a total loss and offers $7,500, but you recently invested in new tires, had low mileage, and see similar cars selling for $9,000. You dispute the value, believing their offer is unfair.

2. Missing or Incorrect Vehicle Info

The insurer bases their value on the wrong trim level (e.g., valuing an LX instead of an EX model), which results in a lower payout. You catch the error and dispute the claim based on proper vehicle features and upgrades.

3. Total Loss vs. Repairable

You want your car repaired because the damage seems minor, but the insurer deems it a total loss to save money. You dispute their decision, arguing that the vehicle can be safely and affordably fixed.

Why Choose ProValue Appraisal?

Certified auto appraisers with over 10 years of industry experience

Independent, third-party valuations that advocate for the policyholder

Quick turnaround – most reports delivered within 2 to 4 business days

Deep knowledge of Los Angeles insurance practices, adjusters, and local market values

ProValue Appraisal stands out by combining experience, speed, and fairness. As certified appraisers with over a decade of hands-on expertise, we deliver unbiased total loss valuations that protect your interests—not the insurance company’s. With fast turnaround times and strong local knowledge, we’re trusted by Los Angeles drivers who want clarity and control during the claims process.